Besides the academic and extracurricular rigor of college, students must also contend with the question of how to finance their time in college. Here is our breakdown of what you need to know when it comes to funding your higher education.

Financial Aid vs. Scholarships

The first step to applying for external funding for college is understanding the difference between need-based and merit-based aid. In the case of need-based aid, more colloquially known as financial aid, funds are issued by the government and are dependent on family assets and level of income. Merit-based aid, also known as scholarships, are awarded by colleges and/or private sponsors based on a student’s achievements in academics and other fields, such as athletics. Merit-based scholarships are usually need-blind, meaning that students are evaluated based on their application and performance rather than their ability to pay for college. In other words, colleges do not see a student’s financial status and funding needs until after the student has been accepted.

Busting the Myths

Students tend to have a preconceived notion that top colleges are not generous with their financial aid and that only a select few students are admitted on financial aid. However, this is often not the case. Take Harvard, for example: Harvard University’s financial aid policy states that undergraduate students who come from families with a total household income below $65,000 have all of their fees waived. Moreover, recent data show that 55% of Harvard students receive some amount of aid, and 20% of them pay no tuition whatsoever. However, one thing to keep in mind is that most colleges’ financial aid is sourced from the tuition paid by other students, so there is a set limit to how many students a school can afford to provide funding for. We highly recommend researching individual school policies to have a clear-cut idea of how much financial aid they can provide.

How Do I Apply for Aid?

For U.S. citizens, there is the Free Application for Federal Student Aid, or FAFSA for short. Many public and private colleges will use this quick and free application to figure out how much aid each student should get. Essentially, the FAFSA will take all the data you enter, most of it being information on your family’s income, and calculate your Expected Family Contribution (EFC). Your EFC is an index number that will then be used by colleges to determine how much aid you are able to receive. The lower your score is, the more money you are eligible for.

The FAFSA opens on October 1st every year and closes on June 30th of the next year. Students are strongly advised to fill out the form as soon as possible to maximize the amount of aid they qualify for, given that some colleges award financial aid on a first-come, first-served basis until they run out of funds. Thus, the earlier you get the FAFSA done, the higher chance you’ll be able to get the amount of aid you need.

Besides the FAFSA, there is also the College Scholarship Service Profile, otherwise known as the CSS Profile. The CSS Profile is open to domestic and international students and is only used by some schools, most of them being private colleges. Please note that approximately 250 schools require the CSS Profile from its students, and they tend to be on the more prestigious side. Unlike the FAFSA, the CSS Profile is not free: there is a $25 fee to send your application to one college and an extra $16 for each additional school that you’d like to send the application to. Furthermore, the CSS Profile will examine your household financial status more thoroughly than the FAFSA, including questions that inquire about the value of your home and any family-owned businesses.

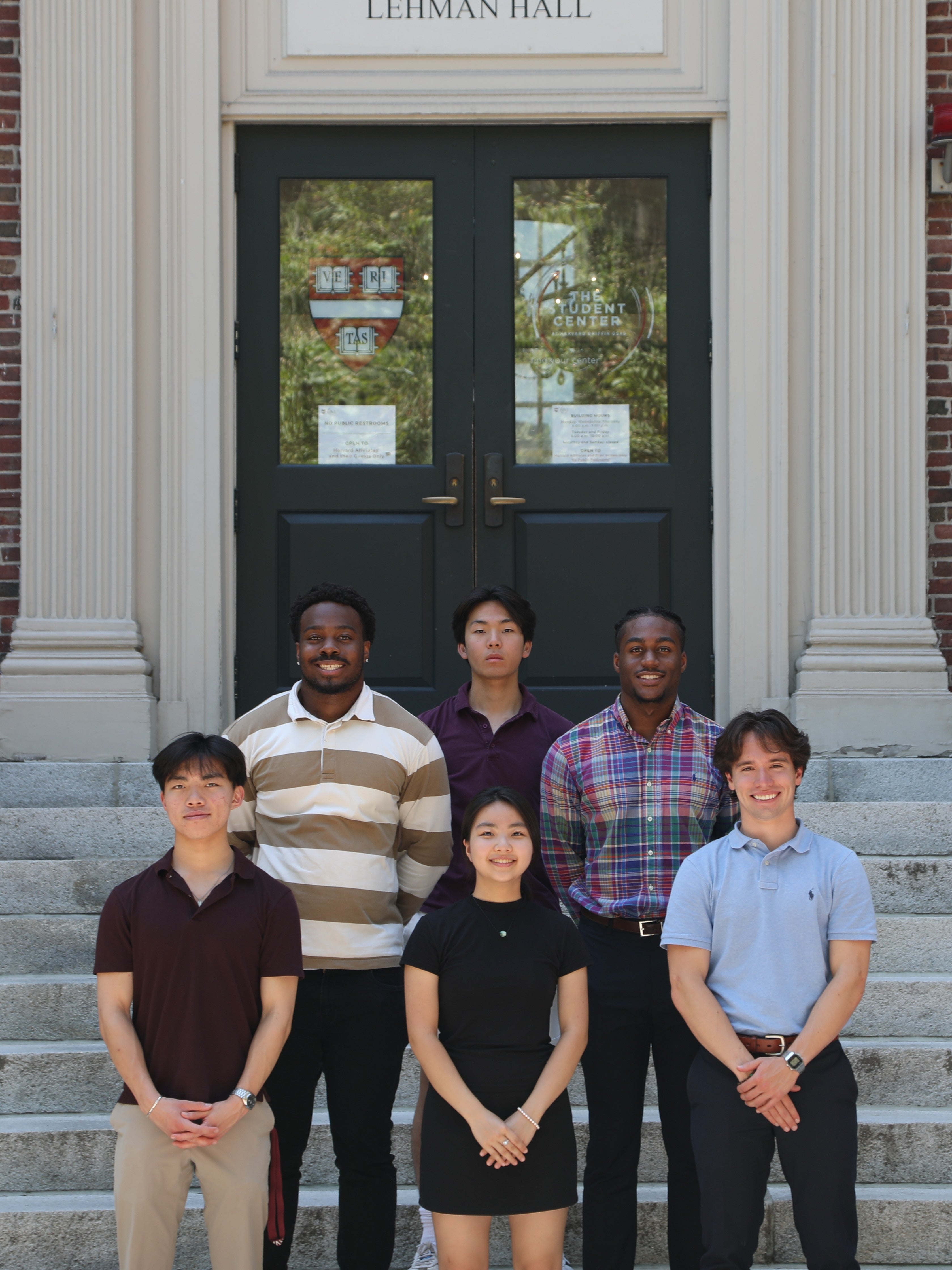

Explore your own options for financial aid and scholarships with a Crimson Coach, Harvard student mentors who can lead you through the ins and outs of your college applications!